Work Bridgeable

Helping low-income families take advantage of RESP support programs

Problem

How to help low-income families save more for their children’s education by taking advantage of government programs such as the Canada Learning Bond (CLB)

Solution

An interactive platform that demystifies the process of applying for a CLB and helps bank employees communicate more effectively with families

Impact

Tools that allow Prosper Canada to have more meaningful conversations with stakeholders about its concepts, resulting in the formation of collaborative partnerships around the future of RESPs for low-income individuals

Author

- Bridgeable

Client

- Prosper Canada

Designing solutions that encourage low-income families to take advantage of RESPs

The federal government offers programs to assist low-income families in saving for their children’s post-secondary education, but these programs have low uptake among the very families they were created to serve. Although extensive research has been conducted into the individual and institutional obstacles that prevent uptake of these programs, solutions have historically been difficult to implement.

When Prosper Canada and Peel Children and Youth Initiative approached Bridgeable to design solutions that help low-income families take advantage of RESP support programs—specifically the Canada Learning Bond (CLB)—there were 125,184 children in Peel Region eligible for the CLB, but almost 60% of them were not taking advantage of it.

Together, we wanted to:

- Better understand and communicate the challenges low-income families face around RESP accounts and government support programs like the CLB

- Identify potential community interventions to boost uptake of these programs

- Make it easier for staff at financial institutions to help families open RESP accounts and access government support programs

Interviews

29

Working prototypes

2

Service blueprint

1

Working with stakeholders to design and validate new solutions

We conducted 29 interviews with bank employees, low-income individuals, and several other key stakeholders over a 33-day period to explore their experiences with financial services and saving. This process revealed a multitude of barriers faced by low-income families, including mistrust of financial institutions, suspicion that there would be a “catch” involved, a lack of motivation to think long-term, and barriers around financial language and jargon.

Based on our insights, we created two personas and mapped their experiences to show the emotional reactions of a subscriber at each stage of applying for an RESP. This helped us demonstrate that there are very few tangible rewards or “feel good” moments to keep subscribers motivated as they move through this complex process.

We gathered together stakeholders from community agencies and financial institutions and key informants specializing in policy and financial literacy to participate in an interactive co-creation workshop. Using customized activities, participants immersed themselves in research findings and tested out ideas for addressing two main opportunity areas: becoming aware of the CLB and signing up. Participants provided insight and context into their roles in the RESP sign-up process and worked with us to build resources that fit the needs of varied stakeholder groups. Some of those concepts were developed into working prototypes that were repeatedly refined and ultimately validated with stakeholders in the field.

Making interaction easy

One of the greatest challenges in getting low-income people to use a savings tool like an RESP is that they have to interact in a sustained way with bank employees—a relationship in which trust and understanding is too often lacking. From the bank’s perspective, an RESP account opening is a rare transaction, and often the bank’s employees are ill-informed about the process. Our platform included an interactive tool that helps bank employees guide potential subscribers through the process of opening an RESP using an illustrated process and relatable stories. This novel way of communicating financial information provided a framework for banks and their customers to communicate on equal footing.

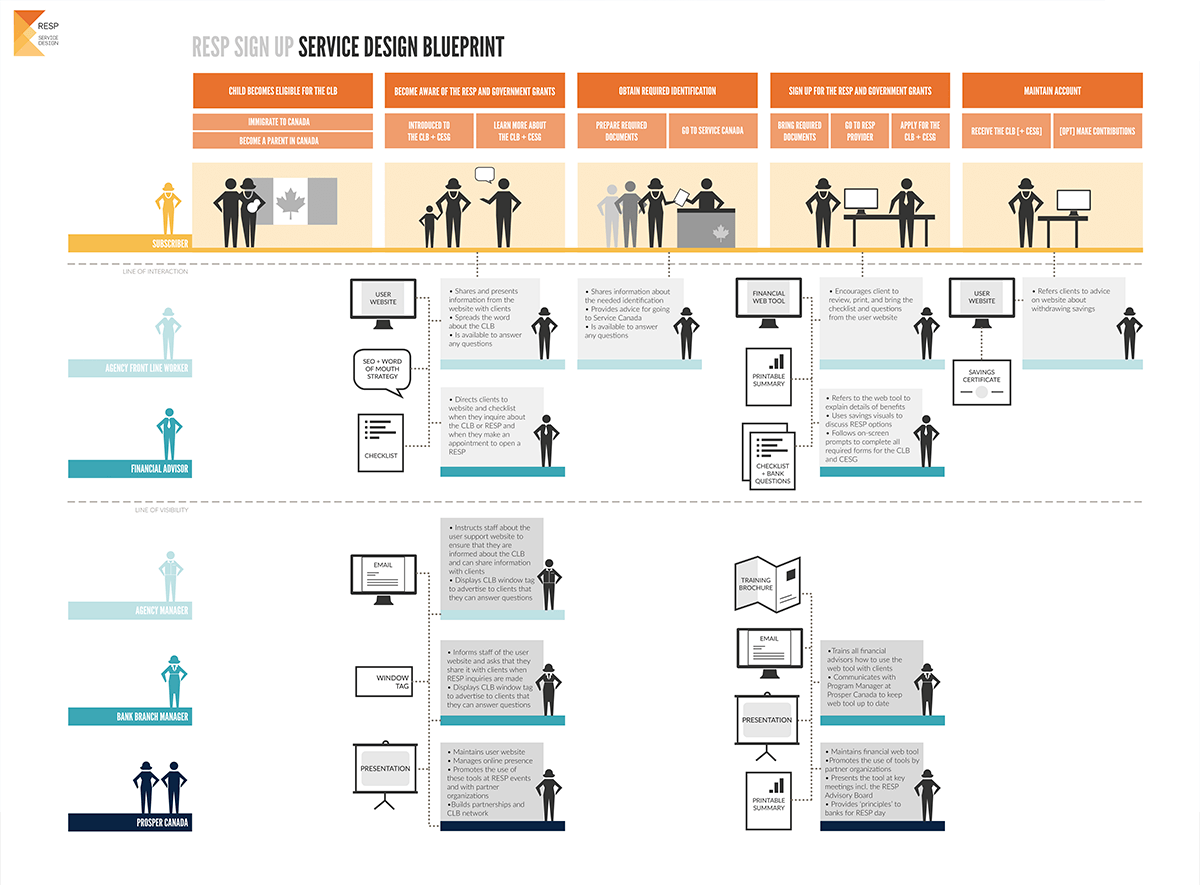

A service blueprint outlined all of the elements needed to implement and support the program—from window tags to boost program recognition to a presentation deck to share with partner community organizations. We also recommended tactics to increase the ease with which people can find the website as well as to help users spread the word and increase awareness of the new online resources.

With the benefit of working prototypes of its online tools for both bank employees and low-income applicants, Prosper Canada was able to have more meaningful conversations with stakeholders about its concepts. These tangible tools showed stakeholders, rather than simply told them, what Prosper Canada imagines for the future. They catalyzed the formation of collaborative partnerships around the future of RESPs for low-income individuals.

Related Work

-

Work A major American pharmaceutical company

Transforming the US health system: Designing a new era of Alzheimer’s Disease care

-

Work The Supreme Cannabis Company

Understanding adult cannabis enthusiasts transitioning to the legal recreational market

-

Work Foodshare

Moving from great food to a great experience