Work Bridgeable

Helping low-to-moderate-income credit union members spend less and save more

Problem

How to help Credit Human, a credit union, connect with its members beyond transactional relationships in a crowded FinTech service landscape

Solution

A new digital tool, co-designed with Credit Human members and staff, to help members make day-to-day financial decisions

Impact

A differentiated product that enables Credit Human to build trust with its members by helping them spend less and save more

Author

- Bridgeable

Client

- Credit Human

Credit unions are struggling to connect with their members beyond transactional relationships. Our partner, Credit Human, wanted to create a unique and differentiated product that engages its members meaningfully in a crowded FinTech service landscape with multiple new entrants.

Credit Human was already working with a technology provider to create a digital tool that would help their members spend less and save more, but they were wrestling with the challenge of member engagement, particularly among low-to-moderate income (LMI) members.

Bridgeable set out to create a new digital tool that meets the Ontario Digital Service Standard to help Credit Human members make day-to-day financial decisions and ultimately spend less and save more.

Framing the challenge

To set ourselves up for success, we worked with Credit Human to set up three major questions for the work to come: Who are Credit Human’s members, and what are their key financial behaviours? What products and services will have the greatest impact on these behaviours? And what will be most valued and trusted by members?

Understanding Credit Human members

We analyzed existing Credit Human market research and segmentation and conducted 11 in-depth interviews with Credit Human staff and members to better understand our users and their finances and to identify the pain points in their experiences.

Through this process, we learned that members are highly conscientious about their finances and demand control over their money. This demand for control is evidenced in behaviours such as checking account balances multiple times each day. Members find value in saving but struggle to build enough to cover unexpected expenses, leading to a cycle of reliance on predatory loans.

I already keep track of my bills ... but this would be so much easier. This app would replace my Excel spreadsheet.

Credit Human member

Identifying the solutions that have the greatest impact

We convened 12 members and 4 Credit Human staff in a learning lab—an interactive group research activity—to tell their stories of financial change, share the barriers that they faced, and identify features that might help address these challenges.

Through this learning lab, we learned that members want guidance to help them with overspending and saving. They need this help because they are overburdened by all the information they keep in their heads. They want help in making their day-to-day spending decisions easier.

Co-designing high-value features with members

We gathered together members, Credit Human staff, and a technology partner to co-design key features of a digital tool using a series of facilitated activities.

By creating alongside members, we discovered that knowing how much money is available to spend is invaluable for members to make day-to-day decisions—it ensures members don’t overspend, using money that needs to be set aside for bills. This led us to design features that provide proactive messaging that lets members know when they could save money, and when they should start preparing for upcoming expenses.

Staff and members engaged

83

In-depth interviews

11

Building on a co-created foundation

To ensure that our digital solution would deliver optimal value to members, we built working prototypes for an app and tested them with 60 users on site in Credit Human branches. This allowed us to evaluate and evolve the app’s features, usability, and trustworthiness.

Our key insight was understanding the balance between recommendations and control. Members wanted the digital solution to “do the math” for them, but also give them the power to update and revise the recommendations. They wanted the final call to be in their hands.

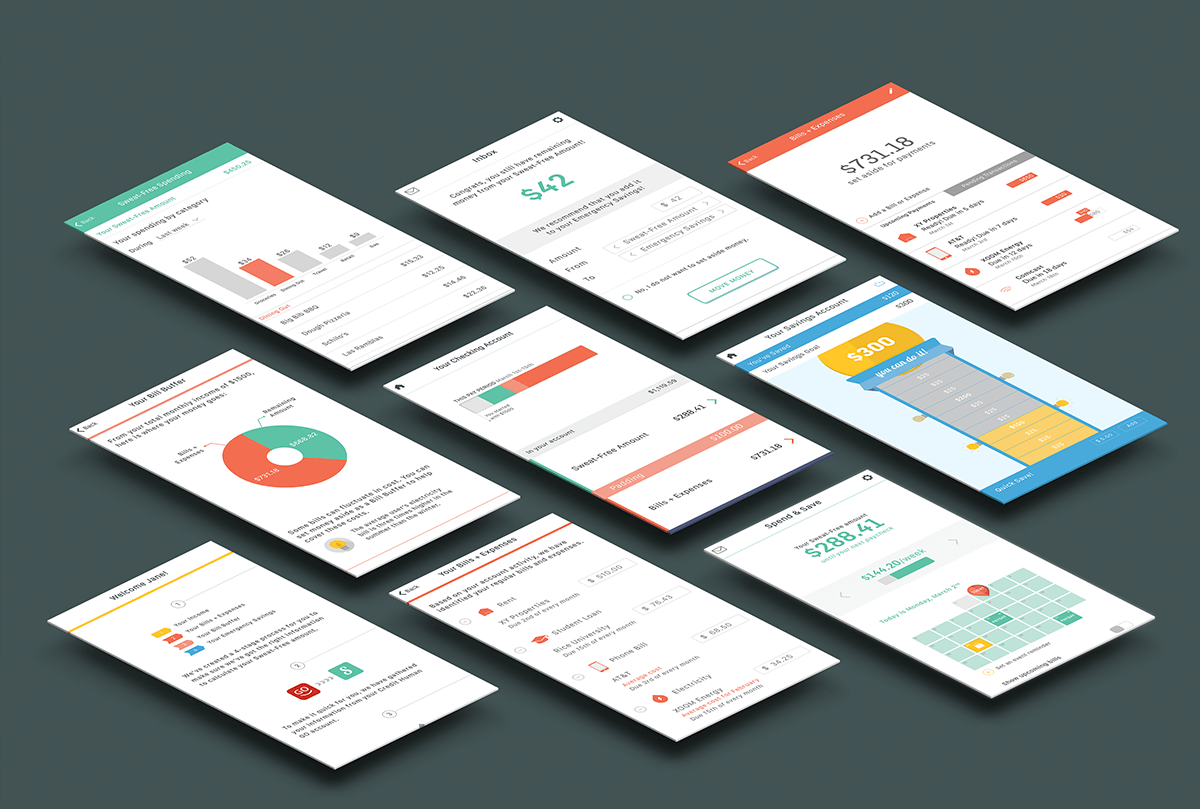

Introducing Spend & Save

The final app, Spend & Save, was built through this process of research, co-creation, and validation. It allows members to know how much money is really available to them through a Sweat-Free Amount—the amount available to spend after factoring things like bills, expenses, and a Bill Buffer to cover fluctuating bills.

Members are notified when they have funds available in their Sweat-Free Amount at the end of their cycle. When members are encouraged to save, they are more likely to put money aside for emergency savings rather than spending it.

Right now, I have no way of seeing my spending. That’s why this is so appealing. It’s scary to sit down and figure out where my money’s going.

Credit Human member

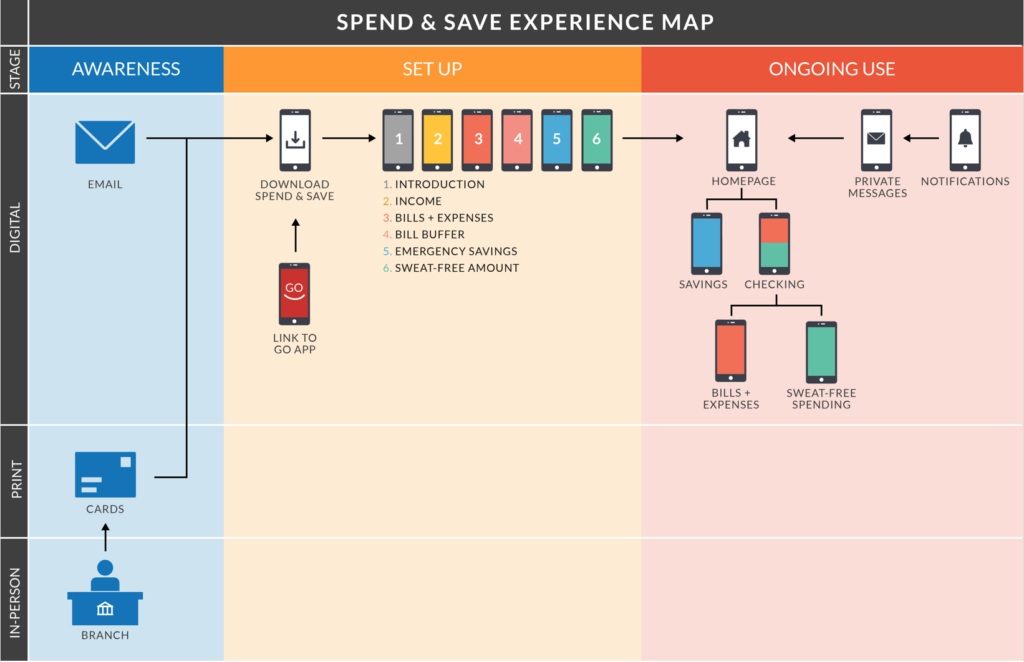

Moving from transaction to engagement through building trust

We learned that the key factor in moving members from transaction to engagement is building trust. Spend & Save builds trust in every member interaction, starting with how users first hear about the product.

Because LMI members tend to lack knowledge and experience with FinTech services, we developed messaging to equip branch employees to build trust and awareness of the digital solution outside of the tool itself. Messaging materials introduce the app’s value and highlight its core functions and clearly articulate how Spend & Save will help them ease daily spending decisions.

The Sweat-Free Amount feature relies on members trusting the information provided so they can make spending and saving decisions. Employees can help build this trust through a 6-step setup process that mirrors members’ mental models of budgeting in order to calculate their own Sweat-Free Amount. Walking through the process step-by-step, members see how the Sweat-Free Amount is calculated and learn to trust that it’s accurate. So that members continue to trust their Sweat-Free Amount as they use the app, all of the information that factors into their SFA is easily accessible, clearly displayed, and editable.

Fostering long-term member engagement through ongoing benefits

Spend & Save provides immediate, short-term, and long-term benefits to Credit Human members. The Sweat-Free amount lets members know how much of their income is safe to spend at any given moment. The app also makes it easy for them to plan and prepare for their upcoming expenses, including unexpected ones. Finally, Spend & Save helps members set up attainable savings goals and equips them to reach their goals through tailored features.

By providing members with real value in the form of ongoing benefits, Spend & Save both differentiates Credit Human’s offerings in a competitive FinTech environment and helps it foster trusting, long-term relationships with its members.

Related Work

-

Work Bristol-Myers Squibb

Reimagining the informed consent experience in clinical trials

-

Work Canadian Institute for Social Prescribing

Social Prescribing: A holistic approach to improving the health and well-being of Canadians

-

Work Canadian Institute for Social Prescribing

Social Prescribing: Building toward a national framework