Ideas by Bridgeable

How to be agile in a changing financial ecosystem

Author

- Bridgeable

How will traditional banking and financial services stay relevant in a changing financial services ecosystem? The rapid growth of the fintech industry has introduced new players, technologies, and business models to financial services. But there is a tendency to analyze the rise of fintech as a signal for digitization of financial services.

While digitization has been a central component of fintech, it is underpinned by different methods of understanding customer needs and connecting these needs to service offerings. Organizational agility — the capacity of companies to rapidly adapt to changes in the financial ecosystem — is a key strategic advantage that fintech companies leverage.

Traditional banks and financial service providers are asking “How can we adapt? How can we engage with new practices and strategies while maintaining our core legacy systems, strengths, and the relationships we’ve built with our clients?”

Bridgeable worked with GreenPath Financial Wellness — a leading American financial wellness organization – to tackle this type of problem. GreenPath has long offered many different services, including financial counseling, but wanted to explore ways that they could adapt these services to enable more clients to achieve long-term financial stability and promote financial wellness through preventative approaches.

GreenPath wanted to improve upon a system embedded across 60 offices in 16 states. To do so, GreenPath engaged a joint partnership with Bridgeable and the Common Cents Lab from Duke University — a leading behavioral economics lab. Our experience with this wide-reaching challenge could help others who are looking to adapt to the new world of financial technology. Here are some steps we used in our sprint with Greenpath that might get you started:

How to get started

Narrow, specific, and testable

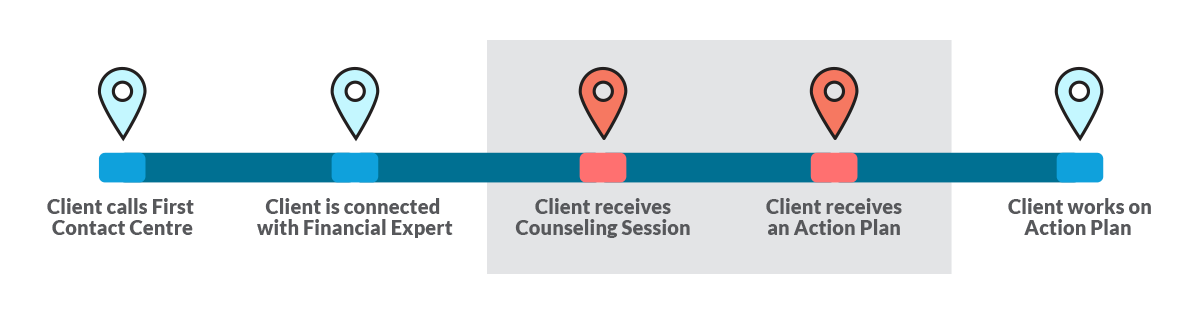

In trying to build organizational agility there can be an urge to start by rebuilding an entire service. However, early projects should start with a narrow, specific, and testable focus area. With GreenPath, our starting point wasn’t redesigning the entire service from scratch. We began by focusing on the counseling session between GreenPath and their clients, as well as the action plan that clients receive after their session.

By setting up a narrowly defined challenge to focus on, we were able to quickly implement changes and measure specific outcomes. In this case, we were able to zero in on whether clients were making behavioralchange to improve their financial well-being. Showing quick wins and outcomes in this specific area would also help drive a broader movement towards agility.

Involve your stakeholders

Multiple stakeholders play a vital role in the success of a service, including staff and customers. Uncovering the latent needs of frontline staff and customers is critical to organizational agility. Involving these stakeholders in building solutions is a low-cost, effective way to ensure solutions meet needs and will be impactful. During the first week of our sprint, we collaborated with GreenPath Financial Experts and clients to understand their perspectives, helping to focus the development of a new call session prototype.

We didn’t just engage staff in the design of the prototype, we also engaged them in evolving it. After building a prototype, we took it back to front-line staff at GreenPath who used it in real sessions with clients over the course of a week. Immediate debriefs were held after each of these sessions to gather fresh feedback and ensure we were constantly understanding and capturing valuable insights. Creating this discussion space led to impactful and meaningful iterations with staff and clients.

Real world, real results

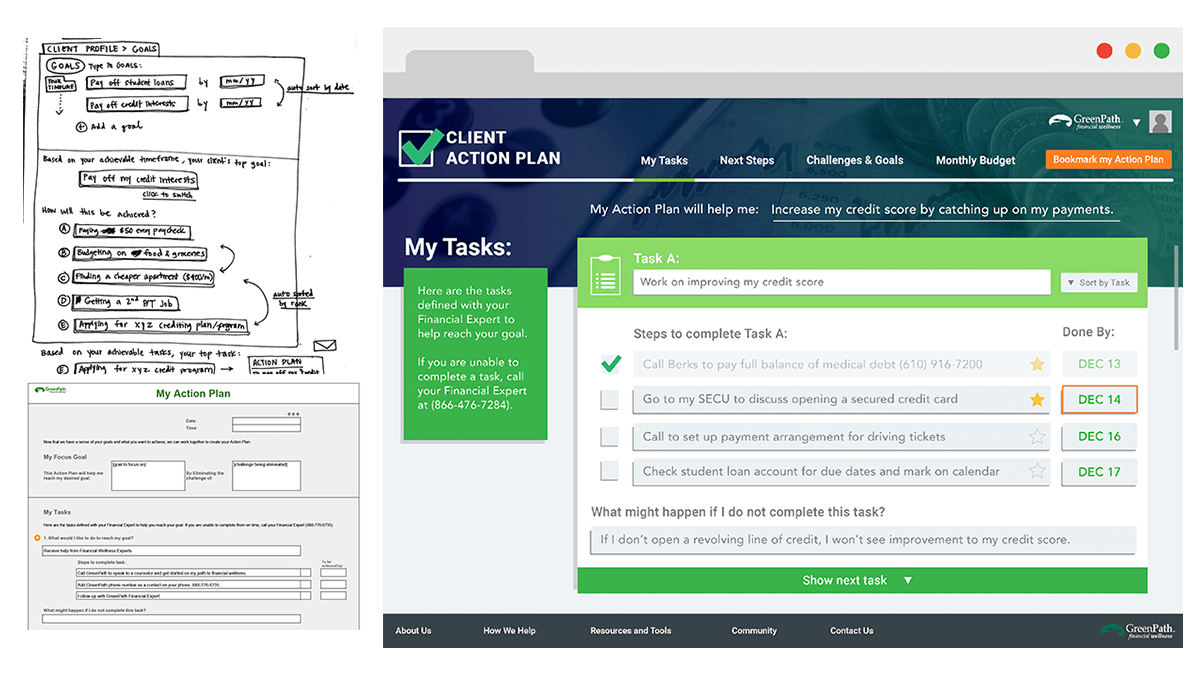

Organizational agility means being able to quickly identify what works and what doesn’t in the real world, and to move forward on effective solutions quickly and confidently with deeper levels of investment. To test the assumptions and changes we made to the counseling process, we needed to prototype quickly. It was unclear at first whether a digital action plan was going to be effective; rather than coding and building a new action plan, we quickly tested the efficacy of this tool by creating a working digital action plan in Google Sheets. This interface allowed us to implement the prototype in the real world, with the ability to make updates in a matter of minutes.

GreenPath counsellors tested the prototypes with new clients, giving us the insights we needed to clarify what features worked and what features we needed to revise or remove. This process allowed us to validate that a digital action plan was valuable and to quantify the specific features that made this prototype effective at low cost. Real world testing created organizational momentum at GreenPath, which they used to move forward with deeper investment in this new service confidently.

What impact did this have on GreenPath?

These starting points resulted in a huge leap forward and were crucial for establishing organizational momentum for GreenPath. Through this collaborative effort, we demonstrated the potential for substantial impact on Financial Experts and clients and built prototypes that were real and interactive. These outcomes helped GreenPath to implement a new service model that will be carried forward and tested through a randomized controlled trial with the Common Cents Lab to assess its impact on financial well-being for GreenPath clients. Seeing all this happen in a short 4-week sprint was exciting, and demonstrated the power of agility in creating more engaging and impactful financial services.

- Article written by Seden Lai, Tim MacLeod and Melissa Phachanhla

Author

- Bridgeable

- Article written by Seden Lai, Tim MacLeod and Melissa Phachanhla